Tax Strategies for Cryptocurrency Withdrawals: What Works

Tax Strategies to withdraw cryptocurrencies: what acts

The Crypto Currency World has taken over the financial industry with a storm, and millions of individuals and institutions invest in digital currencies such as Bitcoin, Ethereum and others. However, one aspect that is often neglected or misunderstood are tax liabilities when it comes to withdrawing funds from these cryptocurrencies. The IRS and other governments have conducted different regulations to ensure that they adhere to tax laws, but not all cryptocurrency owners know how to move on the complex networks of tax rules.

In this article, we will explore different tax strategies to withdraw cryptocurrencies and what works best for individuals and companies in the digital currency space.

Understanding Tax Liabilities

The Internal Revenue Service (IRS) defines a taxable event as any transaction that includes financial assets considered to be a taxable recipient. In the case of cryptocurrencies, it includes sales, stock markets or other transactions in which an individual or entity sells or receives a digital property for consideration.

In order to avoid paying a cryptocurrency tax, it is crucial to understand how to report these transactions and what tax strategies are available. Here are some key concepts to keep in mind:

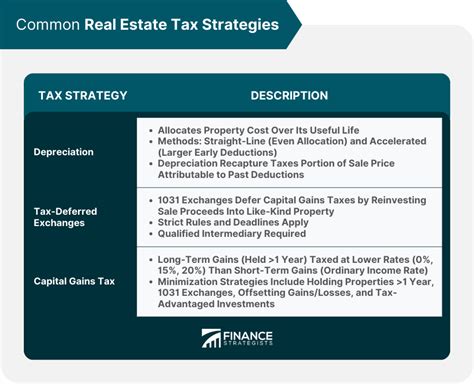

* Capital Gain Tax : If you sold the crypto currency when gaining, gain is subject to the tax rates of capital, which can be ranging from 0% to 20%.

* Taxable Transactions : Cryptative transactions that are not considered taxable are usually exempted, such as:

* Trading between individuals or small businesses for personal use.

* Buying and selling cryptocurrencies for personal investment.

* Receiving a crypto currency as a work fees or services.

Tax Strategies to withdraw

To diminish the tax liabilities to withdraw the cryptocurrencies, consider the following strategies:

- Holding period : Make a record of a time period in which you held a crypto currency. This can affect the capital rate on the capital gain and the time when you are eligible for sale.

- Tax Tax

: If you have losses from other investment or assets, consider using them to compensate for gains on your cryptocurrency transactions.

- Tax effective investment : Consider investing in the crypto currency that are more liquid and have lower tax rates, such as bitcoin.

- Self-exchanged IRA (single pension accounts) : self-mixed IRA allow individuals to hold alternative assets, including crypto currency, within a pension account.

Examples in the real world

To illustrate the effectiveness of these strategies in practice, consider the following examples:

- Self -employed individual CRIPTO Currency for personal use can report a profit schedule for C and request a deduction for the costs associated with their business.

- If you trade between individuals or small businesses for personal use, the capital of capital gains may be lower than if you are selling directly from your own account.

In conclusion, understanding of complex tax rules concerning the withdrawal of cryptocurrencies is crucial for maximizing tax breaks. By applying these strategies and remains informed about the change of tax laws, individuals in the digital currency area may reduce their tax liabilities as they continue to grow their wealth.

additional resources

For more information on tax regulations and strategies specific to cryptocurrency investors, contact the following resources:

- IRS Publication 265 (tax treatment of certain capital gains and losses)

- Law on tax and job reduction (TCJA) Section 199A

- SEC Rule 34 (Reporting on Securities Transactions)

Be informed about the development of tax laws and regulations in the cryptocurrency premises.