What Is A Liquidity Crisis And How Does It Affect Markets?

The Dark Side of Cryptocurrencies: Understanding the Liquuidity Crisis

As the popularity of cryptocurrencies continues to rise, groups are growing over their stability and potential risks. A critical aspect that caused controversy is the liquidity crisis in the cryptocurrency market. In this article, we will delve into what a liquidity crisis, it is effects on markets and why it is Becoming a Pressing Issue for the Entire sector.

What is liquidity crisis?

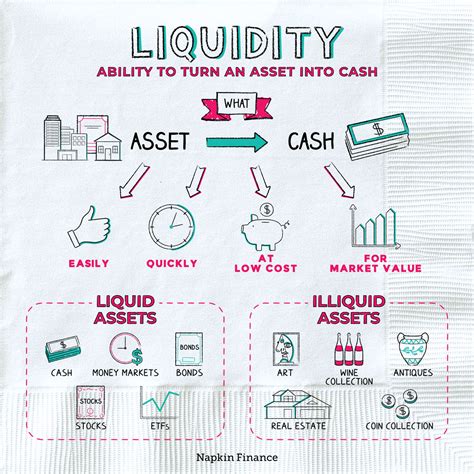

A liquidity crisis occurs when there are not enough commercial activities or sufficient purchasing power to meet the demand of buyers and sellers in a market. This May Happen Due to Various Reasons, Such as less interest to Investors, Regulatory Obstacles, or Increased Security Measures That Make It Difficult to Buy and Sell Assets.

In the context of cryptocurrencies, a liquidity crisis refers to a situation where there are ferwer buyers than salespeople, leading to a decrease in market prices. This can have significantly consistence for investors who keep cryptocurrency on the margin (lending money to trade).

Causes of Liquuidity Crisis

Several Factors Contribute to A Liquuidity Crisis:

- Investor’s Reduced Interest : As the value of cryptocurrencies Such as bitcoin and ethereum decreases, ferwer people are willing or capable of buying them.

2.

- Increased Safety Measures : Strict Loan Policies and Increase in Money Laundering Regulations (AML) Can Discourage Investors From Buying and Selling Assets.

Effects of Market Liquuidity Crisis

A Liquuidity Crisis Can Have Long -Reach Conthequences for the Cryptocurrency Market:

- Market Volatility : Decreased Commercial Activity Can Lead to Higher Prices and Decrease Market Stability.

- Increased Transaction Costs : FEWER BUYERS MEAN Traders should pay more to buy or sell their assets, Increasing Costs.

- Decreased Investor Confidence : A Liquuidity Crisis Can Erode Confidence in the Market, Leading Investors to Reverate Their Investment Decisions.

Examples of Liquuidity Crises

Several Notable Examples Highlighted the Risks Associated With Liquuidity Seizures:

- 2017 Bitcoin Correction : Bitcoin Price Fell Almost 50% between December 2017 and January 2018

2.

How Can Investors Mitigate the Risks?

AltheHe A Liquuidity Crisis Is Worrying, Investors Can Take Steps to Mitigate Their Risks:

- DIVERSIFY Your Portfolio

: Spread Investments in Various Cryptocurrencies to Reduce Exposure to Any Asset.

- hedge your term : Consider using stop orders or other hedge techniques to limit possible losses.

- Stay Informed : Stay up to date with market news and regulatory changes that may affect liquidity.

Conclusion

A Liquuidity Crisis is a pressing issue for the cryptocurrency industry, with Long -Reach Conthequences for Investors and Traders. As Investors’ Interest in Cryptocurrencies Continues to Grow, IT is Essential to Remain Vigilant and Prepared for Possible Challenges. Understanding the causes and effects of a liquidity crisis, investors can take steps to mitigate risk and navigate the complex world of cryptocurrencies.

Recommendations

* KEEP Informed : Monitor Market News and Regulatory Developments.

* DIVERSIFY YOUR PORTFOLIO : Spread Investments in Various Cryptocurrencies.

HEDGE YOUR BETS : Consider using stop orders or other hedge techniques.